By Zachary Hansen

Buy-to-rent push puts home ownership further out of reach in metro Atlanta.

Big institutional investors that buy up houses to rent have made metro Atlanta one of their largest markets in the country, targeting majority Black communities in particular and worsening the affordability crisis, an Atlanta Journal-Constitution investigation found.

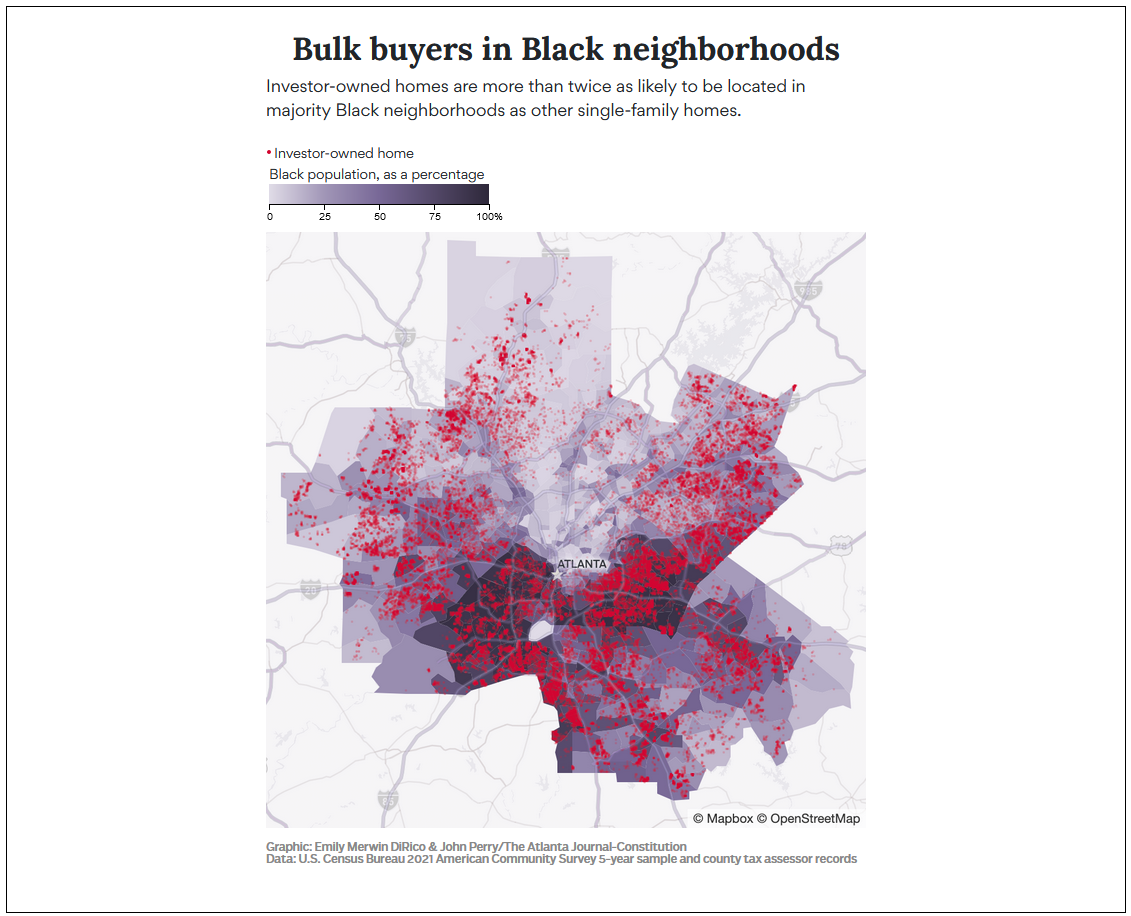

Wall Street landlords are more than twice as likely to buy homes in African American neighborhoods than majority white communities, the AJC analysis shows. Large investment firms, backed by billions of dollars, have scooped up so much inventory in Atlanta’s southern suburbs, experts say, they’ve inflated sales prices and wield outsize influence in the rental market, giving the firms substantial power to hike rents.

They also have the financial firepower to outbid regular homebuyers, becoming another barrier for renters in minority areas to own a home and build equity.

The buy-to-rent phenomenon is the latest roadblock to Black home ownership, housing experts say, in a long history of practices and policies that have helped fuel longstanding racial disparities in the U.S. and Atlanta.

“Once you start changing the dynamics in terms of where people get to live, it has an impact not just on that individual but generations down the line in terms of their health, their education, their jobs and also their general ability to generate wealth,” said Samyukth Shenbaga, the manager of the Atlanta Regional Commission’s Community Development Division.

________________________________________

American Dream for Rent: Our Findings

Across the Sun Belt, investment firms are extracting wealth where families normally build it: the single-family home.

Since the Great Recession, large investors have snapped up more than 65,000 homes in metro Atlanta and converted them to rentals. And the flood of Wall Street cash is pushing homeownership out of reach for many middle-class families.

Investors buy in all but the wealthiest neighborhoods, but their homes are disproportionately found in African American communities.

Priced out of buying, families who wind up renting from these same firms can face deplorable conditions, exorbitant fees and frequent eviction filings by out-of-state landlords driven to maximize shareholder profits.

Metro Atlanta is ground zero for the investor takeover of the American Dream.

________________________________________

The AJC examined purchases by bulk buyers, which the newspaper defines as owners of more than 50 houses across the region, and found these firms have accumulated more than 65,000 single-family homes in 11 counties since 2012.

Four out of five census tracts where investors bought at least 50 homes since 2021 were majority-minority. Roughly 45% of those census tracts were ones with more than 90% minority residents.

In some neighborhoods, bulk buyers own a majority of houses.

Metro Atlanta home values have risen across the board from 2012 to 2022. But the AJC’s analysis found they climbed more sharply in places where investors own more houses. In the 30 ZIP codes with the most investor-owned properties, home values appreciated at nearly twice the annual rate as the 30 ZIP codes where investors own the least.

Some of the biggest price appreciation in metro Atlanta has occurred along or south of I-20, historically a racial dividing line in the region.

Majority Black Clayton County saw the highest home price appreciation from January 2020 to last December, up 71% in that time. Three other majority Black counties followed — Rockdale (69%), Douglas (68%) and Henry (64%).

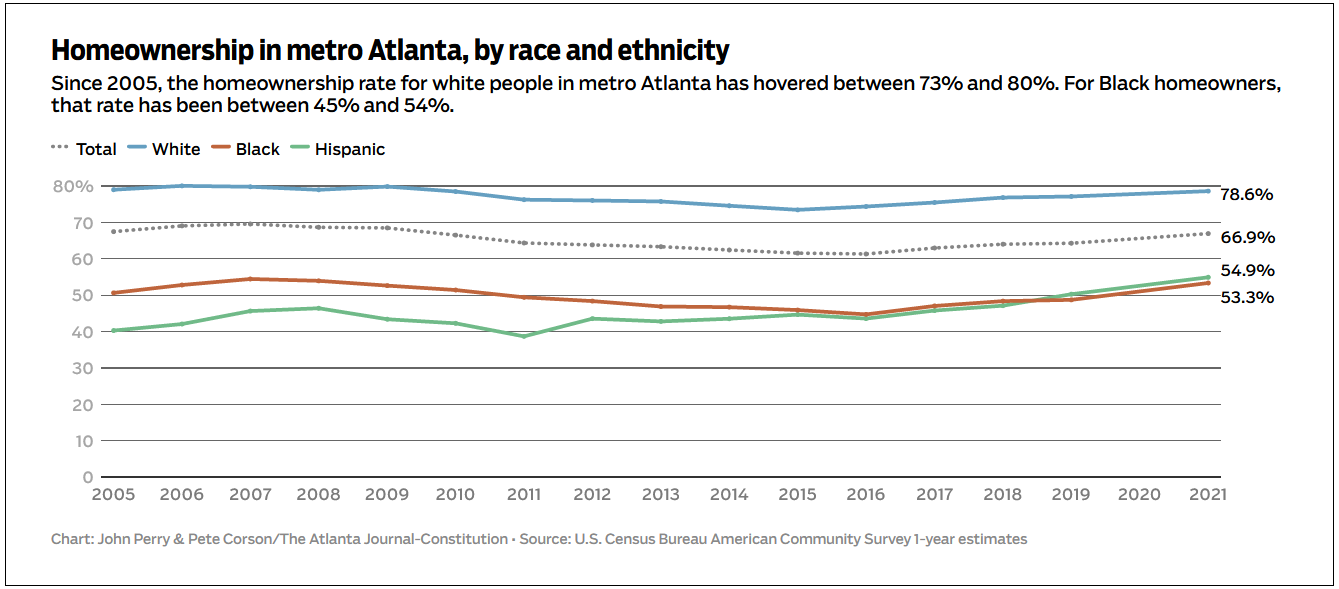

Homeownership has been a top source of middle-class wealth building for generations. Nearly three-quarters of white households in the U.S. own their own homes, compared to less than half (45.2%) of Black households, according to data from the Federal Reserve Bank of St. Louis.

A landmark study from Georgia Tech found that the rise in investor activity caused a 1.4 percentage point drop in homeownership rates in metro Atlanta from 2007 to 2016. Black homeownership dropped 4.2 percentage points during that period, the research found, while homeownership among white people was unaffected.

In metro Atlanta, about 53% of Black households own their own home, up slightly since 2016 and a little better than the national average. But about 79% of white Atlanta area households own their own homes.

Institutional investors also are far more likely to own homes today in the neighborhoods hardest hit more than a decade ago by crisis-era foreclosures, which affected communities of color the hardest, the AJC analysis shows.

Wall Street scooped up thousands of lots and foreclosed homes in the aftermath of the Great Recession. Their purchases stabilized economically distressed neighborhoods, industry proponents say. But firms often flipped those houses to other investors as the economy rebounded.

Now Wall Street is back with a new business model — one that experts say inflates home values and rents.

“I think it has worsened the housing inequality in the region,” said Dan Immergluck, a professor of urban studies at Georgia State University.

The trend worries Maureen Webb, who fears the homebuying window is closing for younger generations. The 74-year-old retired nurse crawled her way back to homeownership after a foreclosure. Webb rented until she was able to buy a McDonough townhome in 2020 for $188,000. She recently sold the home at nearly a $100,000 profit. Large investors own 21% of all homes in her census tract, the sixth-highest in the metro area.

Webb said she doesn’t know if she’d be able to afford the last place she rented, let alone buy a house, if she was a young nurse today.

“I’m sure if I was still there, I couldn’t afford it,” she said.

Maureen Webb fears the homebuying window is closing for younger generations. The 74-year-old retired nurse crawled her way back to homeownership after a foreclosure. Webb rented until she was able to buy a McDonough townhome in 2020 for $188,000. She recently sold the home at nearly a $100,000 profit. Large investors own 21% of all homes in her census tract, the sixth-highest in the metro area. (Natrice Miller/natrice.miller@ajc.com)

Dividing lines

Memorial Drive is a dividing line in DeKalb County between wealthier and whiter northern DeKalb and southern DeKalb, which tends to be lower income and majority Black.

More than half of all homes sold in 2021 south of Memorial Drive in DeKalb were to private equity firms, according to an Emory University study.

Lorraine Cochran-Johnson, a DeKalb commissioner, said the county’s racial divide is the result of decades of housing policy, dating back to the days of redlining — a discriminatory practice where mortgage lenders and banks denied Black Americans access to home loans and dictated where they could live. She said the deluge of investor activity has a similar effect.

“Whether or not it is an intentional redlining that’s occurring, it is disproportionately affecting Black and brown communities,” she said. “There’s just no denying it.”

Thirty-five years ago, a groundbreaking AJC investigation, called The Color of Money, found white people in metro Atlanta were five times more likely to receive home loans from mainstream financial institutions as Blacks of the same income. In that 1988 investigation, the AJC found that traditional banks rarely lent in majority Black neighborhoods in Fulton and DeKalb counties, and that race — and not factors like home values or household incomes — consistently determined the lending patterns of the largest banks and mortgage lenders. The investigation led to federal home lending reforms designed to reduce discrimination.

Today, Wall Street is often deploying its capital in minority neighborhoods — just not always to open the doors of homeownership to more people.

Part of the equation is likely simple economics. Wall Street investors target areas where they can buy houses on the cheap and earn higher profits renting them or flipping them than they can in more expensive areas. But homes in many of these lower-cost areas started out cheaper, at least in part, because of the legacy of discriminatory practices in home buying and lending, experts say.

The National Rental Home Council, which represents the largest U.S. rental home companies, denies its members’ buying practices are racially biased or targeted.

“The activity of our member companies has zero to do with the race or ethnicity of individuals in communities where they buy products,” said David Howard, the organization’s executive director.

Home prices are increasing across DeKalb but the fastest appreciation is south of Memorial Drive.

Nine DeKalb zip codes saw home values increase by more than 40% from January 2021 to November 2022, and all but one were south of Memorial Drive or were bisected by the thoroughfare, according to Zillow.

One of the starkest divides is on display between 30032, south of Memorial Drive, and 30033, to the north.

The 30032 zip code, which is three-quarters Black, has household incomes that are about half those of 30033, which is only 14% Black. Median home values in 30032 are about $170,000, less than half those in 30033.

Wall Street has taken notice, acquiring nearly 8% of homes in the 30032 zip code in recent years, compared to just 0.2% in 30033, the AJC found.

‘You just couldn’t compete’

Few places are feeling the investor rush more than in Henry County.

In the 20 census tracts where Wall Street has bought the highest percentage of homes, 15 — or 75% — are majority-minority neighborhoods. Eleven of those tracts are in Henry.

Henry is the second-fastest-growing county in metro Atlanta and in recent years has become a magnet for warehousing and distribution facilities for some of the nation’s biggest brands, including Home Depot, Wayfair and mattress-maker Purple.

Parts of Henry also have seen some of the largest rent increases in the nation. Stockbridge had the second-biggest increase in the U.S. during 2020, a 13.8% rise in monthly rent from $1,306 to $1,412, according to insurance research firm AdvisorSmith.

Carlotta Harrell, the chair of the Henry County Commission, has found herself on both sides of the institutional investor issue.

She listed her home for sale in 2021 and received a flood of offers from investors willing to pay cash for her house, but she turned them down.

“I refused to sell it to an investor. I sold it to a family,” she said.

Eric and Oriana Wyche, seen last month at their Jonesboro home, had to compete with investors in their search. Oriana said with every rejected bid, she got a similar answer. “A lot of them told me it went to an investor who could close sooner, who could put more money down,” she said. “You just couldn’t compete.” (Miguel Martinez / miguel.martinezjimenez@ajc.com)

Oriana Wyche, who bought Harrell’s house, said she was trying for months to find a larger home for her growing household of five. She placed 11 bids during her search.

Wyche, a real estate broker for 18 years, knows the ins and outs of the market. She said she never expected to have such a hard time finding a house. But with every rejected bid, she got a similar answer.

“A lot of them told me it went to an investor who could close sooner, who could put more money down,” she said. “You just couldn’t compete.”

After Harrell sold her house to downsize, she found herself competing with the same investors she denied. It took months, and 16 bids, for her to find her current three-bedroom, ranch-style home in McDonough.

Housing investors became a hot topic in Stockbridge in 2021 when a developer didn’t disclose a new 75-home community would be sold to American Homes 4 Rent, a California-based investor that owns more than 1,000 properties in metro Atlanta and has since rebranded as AMH. It prompted outrage and a moratorium on single-family homes until the city could implement a rental cap.

In a statement, AMH said it was not aware the developer told the city it would be a for-sale project, adding it abided by the city’s laws.

“Majority-minority areas have certainly been sought out and preyed upon, so you get to a point where you need to have the zoning and codes in place yesterday,” said Elton Alexander, a Stockbridge councilman. “It’s almost impossible to put something in place to correct it.”

During the first week of 2023, Henry County imposed a one-year moratorium on applications to build new apartments, townhomes and duplexes to better plan for the growth, officials said.

But moratoriums also slow delivery of new housing, which can make affordability worse. Investors are quick to criticize governments for imposing restrictions, saying there’s demand from people who prefer to rent.

“These actions are not only counterproductive to local economies, but they attempt to segregate people based on how they choose to live,” AMH said in a statement.

Valerie Brown, a Henry real estate agent, said she used to recommend clients avoid buying in neighborhoods with lots of rentals, but that’s become impossible.

“Now, if I recommend that to my clients, they would be on the streets,” she said. “There wouldn’t be any place to live.”

-John Perry, technical director of the AJC’s data journalism team, contributed to this article.

Valerie Brown, a Henry real estate agent, said she used to recommend clients avoid buying in neighborhoods with lots of rentals, but that’s become impossible. (Natrice Miller/natrice.miller@ajc.com)

Read the original story on AJC.com.