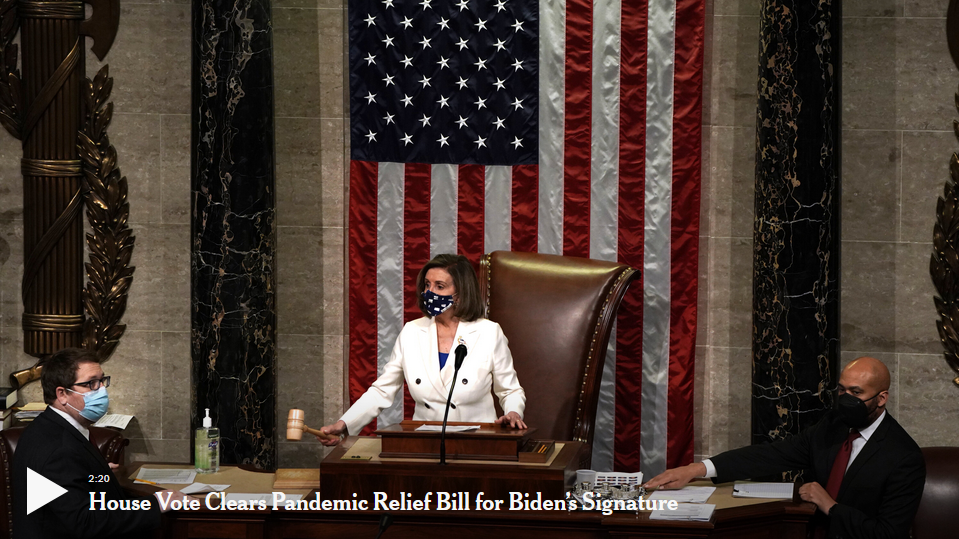

House Democrats prevailed over Republican opposition to give final approval on Wednesday to President Biden’s nearly $1.9 trillion stimulus package in a 220-to-211 vote, clearing the legislation for his signature. Credit…Anna Moneymaker for The New York Times

By Emily Cochrane

The bill, which President Biden is expected to sign on Friday, sends direct payments to many Americans, expands a child tax credit and extends a $300 weekly unemployment supplement. The Senate confirmed more members of the president’s cabinet.

With House passage, Congress clears the nearly $1.9 trillion stimulus plan for President Biden’s signature.

Congress gave final approval on Wednesday to President Biden’s sweeping, nearly $1.9 trillion stimulus package, as Democrats acted over unified Republican opposition to push through an emergency pandemic aid plan that carries out a vast expansion of the country’s social safety net.

By a vote of 220 to 211, the House sent the measure to Mr. Biden for his signature, cementing one of the largest injections of federal aid since the Great Depression. It would provide another round of direct payments for Americans, an extension of federal jobless benefits and billions of dollars to distribute coronavirus vaccines and provide relief for schools, states, tribal governments and small businesses struggling during the pandemic.

“This legislation is about giving the backbone of this nation — the essential workers, the working people who built this country, the people who keep this country going — a fighting chance,” Mr. Biden said in a statement. He said he looked forward to signing what he called a “historic piece of legislation” on Friday at the White House.

The vote capped off a swift push by Mr. Biden and Democrats to address the toll of the coronavirus pandemic and begin putting in place their broader economic agenda. The bill is estimated to slash poverty by a third this year and potentially cut child poverty in half, with expansions of tax credits, food aid and rental and mortgage assistance.

Mr. Biden and congressional Democrats planned an elaborate effort to promote it throughout the country, seeking to highlight an array of measures including tax credits for children and enhanced unemployment aid through Labor Day. The effort will begin on Thursday with a prime-time address by Mr. Biden.

The campaign is intended to build support for provisions they hope to make permanent in the years to come, and to punish Republicans politically for failing to support it.

Rather than haggle with Republicans who wanted to scale back the package, Democrats fast-tracked their own measure through the House and Senate without pausing to court Republican support. They stayed remarkably united in doing so, with just one Democrat, Representative Jared Golden of Maine, voting against the final measure.

“This is the most consequential legislation that many of us will ever be a party to,” Speaker Nancy Pelosi of California said at a news conference after the bill’s passage.

Earlier, she had dismissed the lack of Republican support and said opponents would not hesitate to claim credit for the popular elements of the plan, saying, “It’s typical that they vote no and take the dough.”

As if to make her point, Senator Roger Wicker, Republican of Mississippi, tweeted approvingly just hours after the bill passed about the $28.6 billion included for “targeted relief” for restaurants. His post did not mention that he had voted no.

“I’m not going to vote for $1.9 trillion just because it has a couple of good provisions,” he later told reporters.

The measure will provide $350 billion for state, local and tribal governments; $10 billion for critical state infrastructure projects; $14 billion for the distribution of vaccines; and $130 billion to primary and secondary schools. The bill also includes $30 billion for transit agencies’ $45 billion in rental, utility and mortgage assistance; and billions more for small businesses and live performance venues.

It provides another round of direct payments to American taxpayers, sending checks of up to $1,400 to individuals making up to $80,000, single parents earning $120,000 or less and couples with household incomes of no more than $160,000.

Read the original story on AJC.com.